Independent brewing sector sees strong sales and demand but financial pressures and market access restricting growth

SIBA UK Brewery Tracker reports second consecutive quarter of decline

Figures released today show the total number of breweries in the UK has continued to decline despite the sector reporting strong sales, with a -29 net closure rate across the UK and no region in growth for the second consecutive quarter.

The figures released today by the SIBA UK Brewery Tracker show the total number of active UK breweries now stands at 1748, a -29 net drop since the end of Q1 2024. The SIBA UK Brewery Tracker takes into account all brewery openings and closures to give an accurate picture of the number of active brewing businesses.

The figures make for sobering reading, with small independent breweries struggling against rising costs and legacy Covid debt despite strong sales in the sector; production volumes now having returned to pre-covid levels and cask beer production being in double digit growth*.

“Independent brewers are reporting good sales growth and strong consumer demand, yet breweries continue to close. For most breweries the challenge is financial pressures from rising costs and market access, as well as lingering Covid debt – something SIBA has strongly lobbied Government for help on.” Andy Slee, SIBA Chief Executive.

With the price of a pint at an all-time high independent brewers cannot pass significant price rises in raw materials, energy and production on to their customers, making access to market and help with financial pressures the most pressing factors in helping brewery numbers stabilise.

“Where independent beers are stocked they sell well. They just need more opportunity to do so.” Andy Slee added.

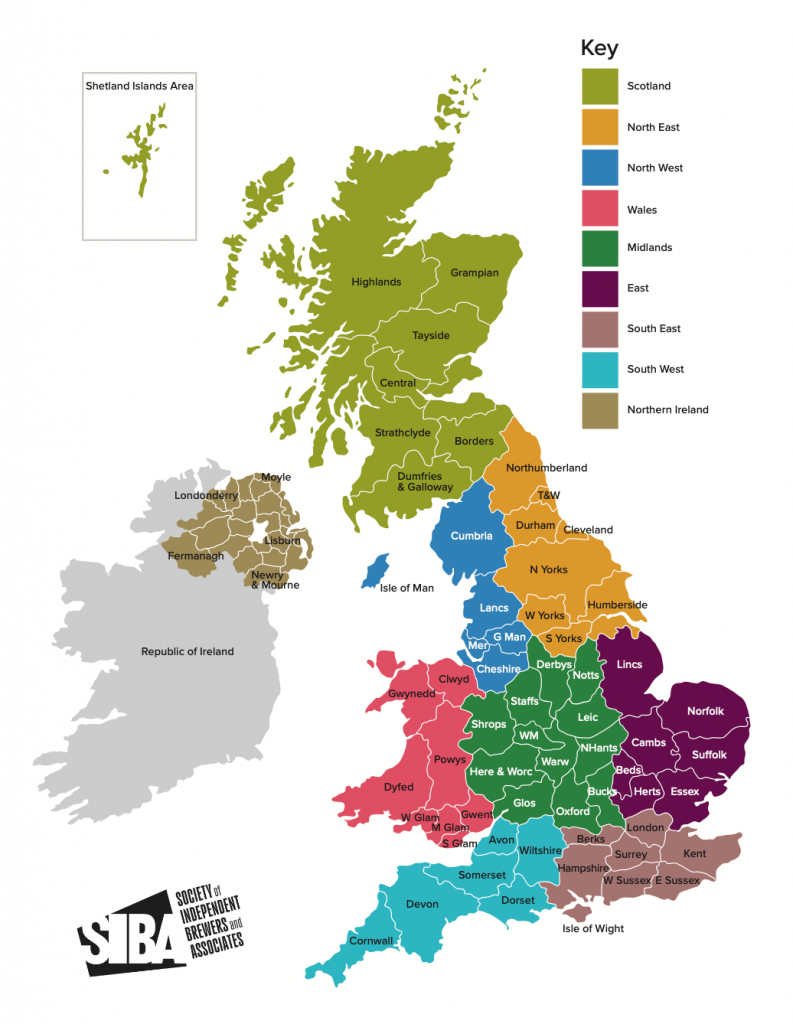

Examining the figures regionally it is clear the Midlands were by far the worst hit in the second quarter 2024, with a Net closure rate of -11, followed by the East and South West who each saw a -4 net closure rate. Scotland, the North East and the South West faired only slightly better, each posting a -3 net closure rate. The East and North West experienced a more moderate -1 net change, with Northern Ireland and Wales both maintaining their brewery numbers during the second quarter, with no change to their net figure.

The SIBA UK Brewery Tracker is compiled by a team of professional staff employed by the Society of Independent Brewers and Associates and is cross-referenced by SIBA Regional Directors in each of the eight SIBA Regions across the UK. The organisation considers a number of factors and data-sources alongside its own data analysis and extensive research and has become the go-to reference for accurate, up-to-date brewery numbers in the UK.

SIBA UK BREWERY TRACKER Q2, 2024

Covering period 01/04/24 – 30/06/2024

UK: 1748 (-29)

Scotland 133 (-3)

Northern Ireland 29 (-)

East 187 (-4)

North East 248 (-3)

North West 189 (-1)

Wales 96 (-)

South West 203 (-4)

South East 331 (-3)

Midlands 334 (-11)

The above shows the new total number and net change compared to 31.03.23

Please note: Due to a change in SIBA’s membership regional boundaries, from 2024 onwards the breweries previously in ‘West of England’ are now counted within the ‘Midlands’ region

Further information

- *Source: SIBA Independent Beer Report 2024

- Due to a change in SIBA’s membership regional boundaries, from 2024 onwards the breweries previously in ‘West of England’ are now counted within the ‘Midlands’ region

SIBA UK Brewery Tracker Brewery Criteria

- Must be an active business that makes beer and has its own brewing equipment.

- A brewing business that is producing beer at multiple sites counts individually towards regional and national totals.

- A brewery that is producing beer, even whilst being fully or partially owned by another brewery, is counted individually towards regional and national totals.

About SIBA

The Society of Independent Brewers is a not for profit trade association which primarily represents independent craft breweries and supplier businesses in the UK. They recently expanded their membership remit to include international breweries, UK beer retailers and amateur homebrewers.

As well as the newly launched SIBA UK Brewery Tracker the organisation also produce the SIBA Craft Beer Report – a comprehensive analysis of the UK craft beer market which take into account consumer polling, industry data and an in-depth analysis of independent breweries using data from their annual members survey.

For further information contact the SIBA Press Office via press@siba.co.uk